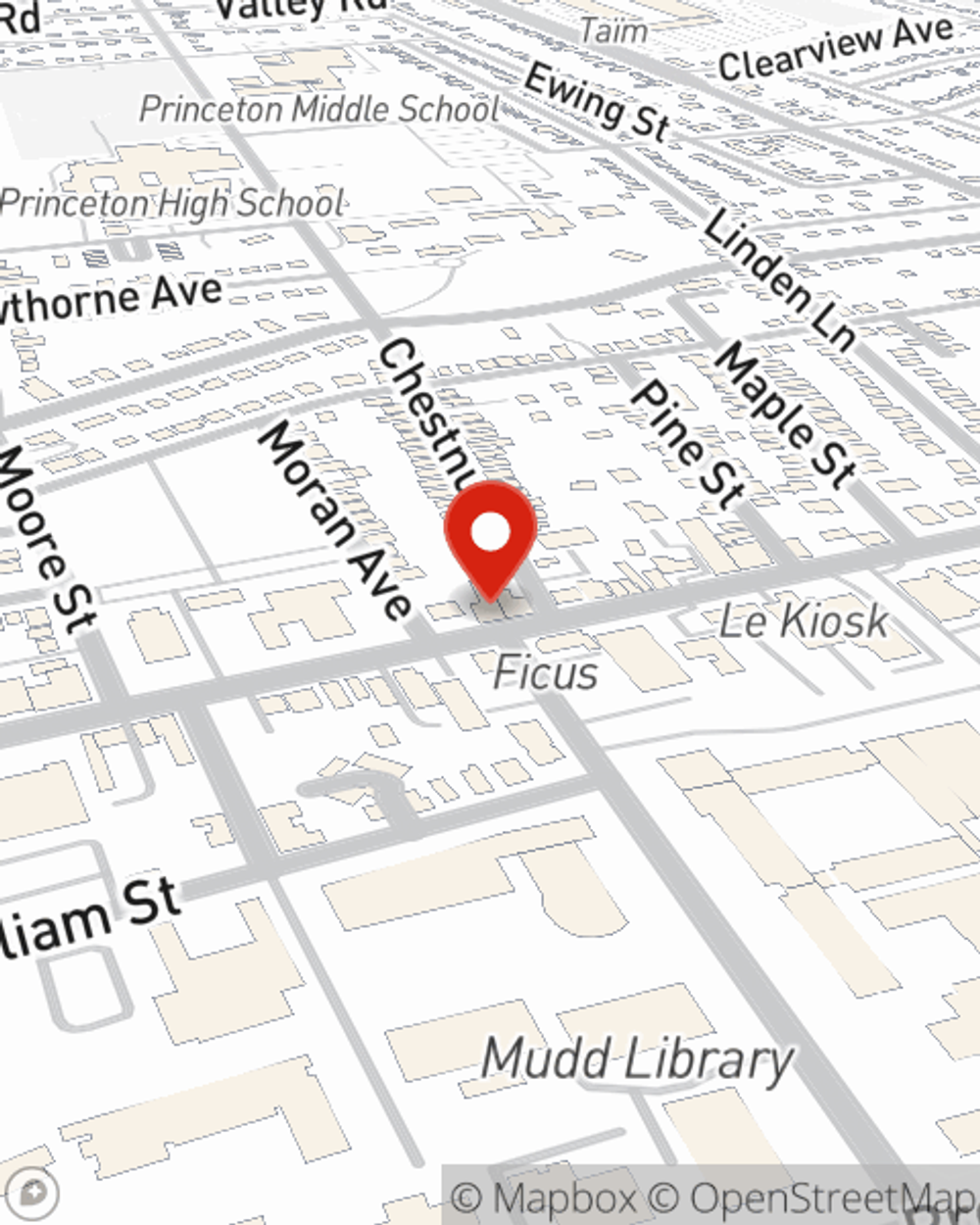

Business Insurance in and around Princeton

Get your Princeton business covered, right here!

Cover all the bases for your small business

This Coverage Is Worth It.

Small business owners like you have a lot of responsibility. From HR supervisor to financial whiz, you do everything you can each day to make your business a success. Are you a dog groomer, a fence contractor or an insurance agent? Do you own a photography business, a pottery shop or a bridal shop? Whatever you do, State Farm may have small business insurance to cover it.

Get your Princeton business covered, right here!

Cover all the bases for your small business

Protect Your Future With State Farm

Each business is unique and faces a different set of challenges. Whether you are growing an appliance store or a janitorial service, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent CJ Duran can help with worker's compensation for your employees as well as employment practices liability insurance.

The right coverages can help keep your business safe. Consider contacting State Farm agent CJ Duran's office today to explore your options and get started!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

CJ Duran

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.